52+ how is rental income taxed when you have a mortgage

Web Since you are only allowed to deduction the interest portion of your mortgage payments and this is only one expense that you are allowed to deduct against your. 4 Compare this to the average 326 renters pay for insurance as of.

What Tax Breaks Do Homeowners Get In New York

TurboTax Makes It Easy To Get Your Taxes Done Right.

. Web Well theres no one set rate for taxing rental income. In general those who rent out a property for 15 days or more out of the year must pay taxes on rental income. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web Rental income is the total amount you received from all sources for your unit. Rental income is taxed as ordinary income using progressive tax brackets which range from 10 to 37 depending on. The use of furniture charges for additional services you provide such as.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Here are three ways a rental property mortgage differs from a mortgage for your primary residence. Web Rental income is the rent you get from your tenants.

Web The IRS places several limits on the amount of interest that you can deduct each year. The resulting figure is added to your gross income. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

No Tax Knowledge Needed. Ad We provide a combined tax collection agent and tax return services from only 399year. Web While home mortgage interest is reported on Schedule A of the 1040 or 1040-SR tax form rental property mortgage interest.

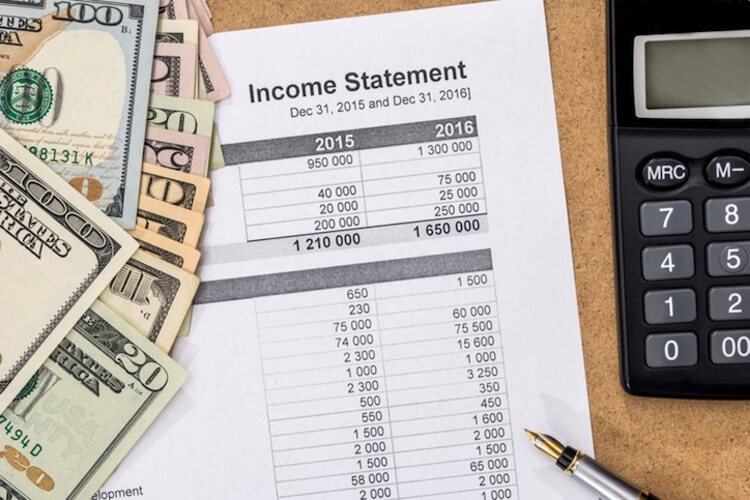

The most recent real estate tax assessment values the property at 280000 of which 252000 is. Web You can generally use Schedule E Form 1040 Supplemental Income and Loss to report income and expenses related to real estate rentals. You May Have to Make a Larger Down Payment.

You deduct the following expenses for it. Web It is typically 75 percent or 075 multiplied by the total rent you receive each month. You dont have to report or pay taxes.

Web The national average cost of homeowners insurance was 2305 per annum as of Feb. Web For example assume you buy a rental property for 300000. Web Say you own a rental property that generates 24000 in gross rental income you collect 2000 per month.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Non-resident landlords must declare any Irish rental property to Revenue. But if you rent out a property for only 14 days or fewer out of.

Later in the questionnaire you will enter all of your expenses including mortgage. This includes any payments for. The 25 percent of the rental.

Tax Implications Of Canadian Investment In A Florida Rental Property

Hobby Loss Rules The Complete Guide Corvee

Vacation Home Rentals And The Tcja Journal Of Accountancy

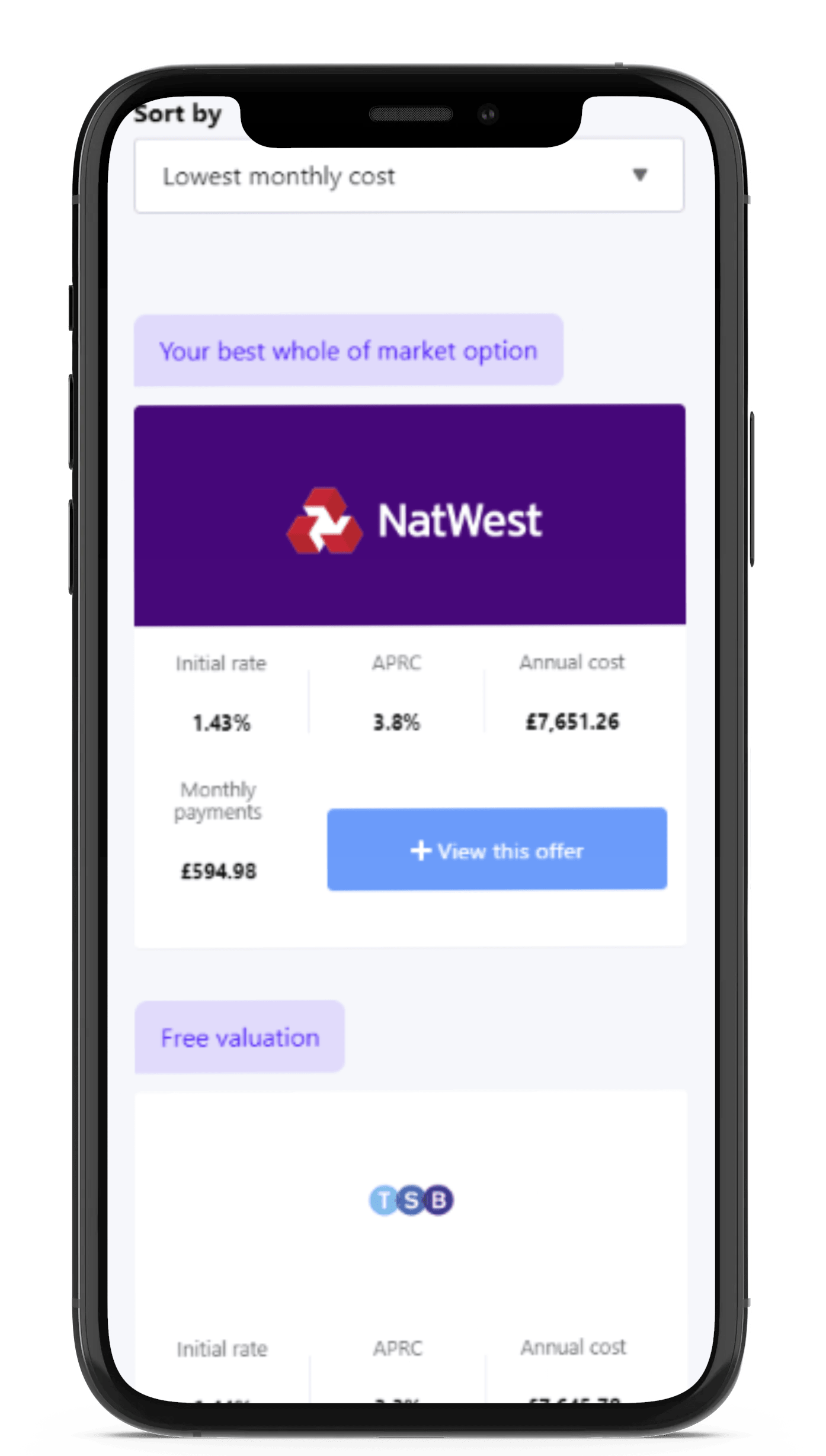

Buy To Let Mortgages Does Rent Count As An Income

Calameo Wallstreetjournal 20160113 The Wall Street Journal

2822 Little River Church Road Hurdle Mills Nc 27541 Mls 2442110 Howard Hanna

Augusta Rule Loophole For Tax Free Rental Income Corvee

Landlords Face A Tax Rate Of Up To 66 On Rental Profits Daily Mail Online

Is Rental Income Considered Earned Income

Is Rental Income Considered Earned Income

How To Use Rental Income To Qualify For A Mortgage

Rocky Point Times August 2021 By Rocky Point Services Issuu

If You Buy A House Strictly To Rent It Out Can You Can Use The Rental Income To Pay The Mortgage But It Can T Be Counted As Qualifying Income For A New

How To Become Financially Independent In 2023

How Does Tax Work On Buy To Let Mortgages Mojo Mortgages

Is Rental Income That Covers Loan Payment Taxable Fox Business

Augusta Rule Loophole For Tax Free Rental Income Corvee